Despite India’s rapidly growing economy, characterized by burgeoning middle and upper classes, widespread poverty remains endemic across the country, and especially so in rural areas. Of the country’s 269.3 million people categorized as poor, nearly 216.5 million live in rural areas, often with limited access to vital resources, ranging from education and running water to capital and markets for goods.

Despite India’s rapidly growing economy, characterized by burgeoning middle and upper classes, widespread poverty remains endemic across the country, and especially so in rural areas. Of the country’s 269.3 million people categorized as poor, nearly 216.5 million live in rural areas, often with limited access to vital resources, ranging from education and running water to capital and markets for goods.

Founded in 2010 by a trio of young entrepreneurs committed to making individual giving more personal, transparent, and sustainable, and inspired by the Kiva model, Milaap believes that loans are a powerful tool for connecting India’s working poor with the resources they need. Through Field Partners—local NGOs and micro-finance institutions across 11 states in India—Milaap has disbursed nearly $1.4 million in loans and helped 9,000 borrowers across India invest in water connections, toilets or solar lights for their homes, vocational education classes, or inputs for their businesses.

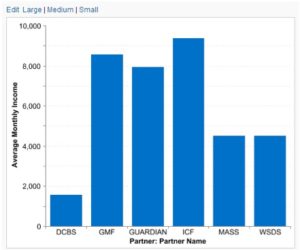

Milaap’s Field Partners evaluate individual loan applicants and disburse money to selected borrowers through their programs, which focus on education, sanitation, energy, water accessibility, and enterprise development. Each Field Partner sends the details of their selected borrowers, including his or her monthly income, expenses, and personal details, to Milaap. These details are used by Milaap’s volunteers to evaluate each applicant’s ability to repay their loan, and to then craft a compelling story for the organization’s website, where individual lenders can read it and choose to donate.

The problem: Milaap was receiving each borrower’s information—from financial data to personal details for the website—in the form of an Excel spreadsheet, with each document often containing more than 100 borrowers’ information at a time. A Milaap staff member would then copy that information into a Google spreadsheet to be used by a volunteer reviewing each application. Without a single tool to store and manage this mountain of data, Milaap staff members were acting as intermediaries, scuttling comments back-and-forth between volunteers and Field Partners, alerting Field Partners should a volunteer flag any issues with a borrower’s application. As the organization expanded to include 20 Field Partners and 30 volunteers this system became unmanageable. “The whole Excel sheet business was turning into a nightmare as we began to scale. There had to be a better way to handle the data on our loans and borrowers,” said Manager of Partner Tools Shubhashree Sangameswaran.

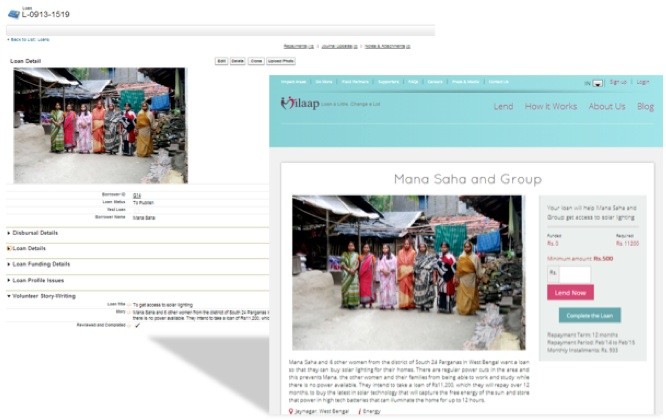

The solution: Vera worked with Milaap to design and implement a Force.com-based web application to manage their loan assessment processes. Instead of relying on cumbersome spreadsheets, Field Partners upload potential borrowers directly onto Salesforce where a Milaap staff member assigns each borrower to a volunteer with the click of a button. With each borrower’s information in a central database accessible to both volunteers and Field Partners, volunteers can more easily flag issues, either with the loan itself or with the information provided, and communicate with the Field Partner to resolve issues directly.

An integration with Milaap’s website allows volunteers to use information in each borrower’s Salesforce record to easily construct a borrower’s story, which is automatically posted from Salesforce to Milaap.org. “[The system] has made it so easy for us to just assign these stories and write them on Salesforce and then push them out. It’s made a huge difference,” said Sangameswaran. When a loan is fully funded through Milaap’s website, its details are updated in Salesforce, where Vera added the ability to schedule and track loan repayments for each borrower.

The new system provides unprecedented visibility into Milaap’s borrowers and lenders. Milaap’s staff can now see which types of loans are most popular amongst its borrowers and, even more crucially, how long it takes to raise funds for each type of loan. “We discovered that smaller loans typically get funded more quickly by lenders,” said Sangameswaran. “We’ve started breaking larger loans into smaller parts to help our borrowers get funding faster.”

As Milaap continues to grow, they hope to use their system to bolster communications with lenders and with a team of Fellows who collect and import updates on each loan directly from the field. This will allow Milaap to send regular updates to lenders on the successes of the borrowers they’ve helped to support and further their vision of changing the way people fund and impact communities in need.